Contents:

https://forexarena.net/Chooser is an excellent place for him to apply his personal interest in trading at his job. A lot is the minimum quantity of a security that can be traded – typically one lot is worth $100,000. Now let’s add 1 pip value for each currency pair and calculate its value for a standard volume of 1 lot.

- You’ve probably heard of the terms “pips,” “points“, “pipettes,” and “lots” thrown around, and now we’re going to explain what they are and show you how their values are calculated.

- This is essential for profit and losses calculations when combined with trade sizes, also known as lots.

- For example, your rolling daily cash price for FTSE might be 7500 bid and 7501 ask.

- The only exception is the Japanese yen, for which the second digit after the decimal point in the price quote denotes a pip.

- This means that the pip value will have to be translated to whatever currency our account may be traded in.

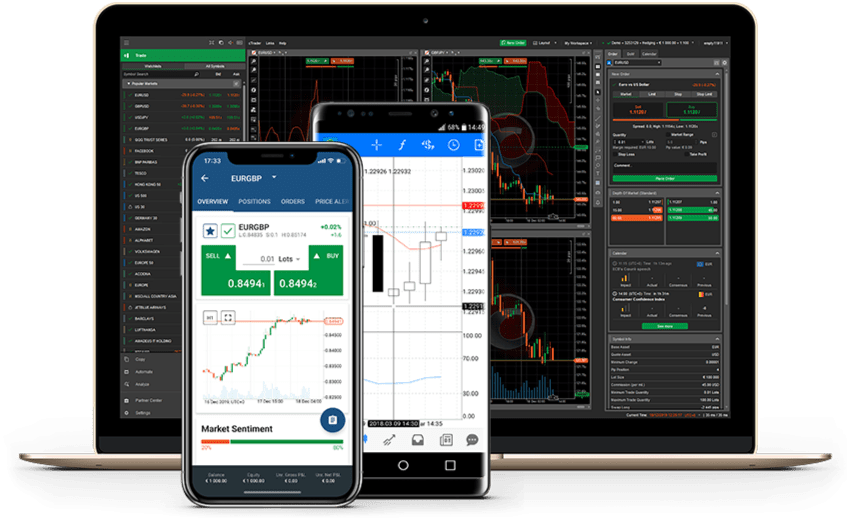

I invite any future https://forexaggregator.com/r to thoroughly read this piece of information since it is essential to their future profitability in the forex market. Calculating the value of pips, especially for cross currency pairs that do not include the U.S. dollar as one of the currencies, can be time consuming and difficult. For that reason, there are pip value calculators that will do the job for you. With a pip value calculator, you simply input your account base currency and the calculator will let you know the value of a pip for the standard lot , mini lot and micro lot . This can save you a lot of time and since it can update in real time you will always easily know what your potential profit or loss is. A pip is a measurement of movement in forex trading, used to define the change in value between two currencies.

What is a pip?

A pip relates to movement in the fourth decimal place while a pipette is used to measure movement in the fifth decimal place. A pipette is a ‘fractional pip’ as it equals a tenth of a pip. Using EUR/USD again as our example, one pip movement using a standard lot will be equal to $10 (0.0001 x 100,000).

Therefore, trading with an appropriate position size is essential. This varies based on the currency pair and your account type, which you can learn more about here. If your broker offers you leverage, your buying power is increased so you could buy even more of an asset and therefore larger lots.

How much money can you make day trading futures?

Over the years, Forex brokers introduced fractional pips or ‘Pipettes’ to offer traders better bid and ask prices while trading, which are actually a smaller part of a pip. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The base value of a trader’s account will determine the pip value of many different currency pairs. A pip, also known as a «point» in currency trading, is worth 1/100th of one cent on most exchanges.

They are called «https://trading-market.org/ettes» and make the spread calculation more flexible. The last two digits of an exchange rate are the points or pips. The most common use for pips is to calculate profit or loss from a position.

What is a pip’s value?

Since most currency pairs are quoted to a maximum of four decimal places, the smallest whole unit change for these pairs is one pip. 30-pips-a-day is a trading strategy used with the volatile currency pairs like GBP/JPY. That is because this approach requires a wide space for trading maneuvers to obtain the required profit margin. Also, volatile currencies often provide clearer market reversal points.

This bid-ask spread also represents the profit that will be made by the FX broker of a transaction if they are able also to find a matching transaction on the other side. Most currency pairs are priced out to four decimal places and a single pip is in the last decimal place. A pip is thus equivalent to 1/100 of 1% or one basis point. If the currency you are converting to is the base currency of the conversion exchange rate ratio, then multiply the “found pip value” by the conversion exchange rate ratio. This calculation is probably the easiest of all; simply multiply/divide the “found pip value” by the exchange rate of your account currency and the currency in question. Desmond Leong runs an award-winning research team advising the largest banks and brokers on where the markets are heading.

Forex, by design, is a high-risk investment—traders should be acquainted with the technicalities. That is, if a currency loses value, imports become more expensive. In such a scenario, customers will not be able to afford imported goods and will be forced to purchase local alternatives. To view an even tighter spread, currency pairs can be given in fractional pips, or ‘pipettes’, where the decimal place is at 5 places, or 3 places if dealing JPY. Lots are measured in units of currency, not by pips (i.e., how the exchange rate moves between the currency pair). Currency Converter Calculate the foreign exchange rates of major FX currency pairs.

- Confirm your email and phone number, get your ID verified.

- It is important to keep abreast of forex daily average ranges when trading, in order to gauge volatility in the Forex Market.

- Convert the pip value into your account currency using the prevailing exchange rate.

- For fast-moving markets, the big figs in the pricing of an FX price are largely omitted as the market makers assume that it is understood.

- I invite any future trader to thoroughly read this piece of information since it is essential to their future profitability in the forex market.

- It is important to note that pips do not represent any actual cash value – that depends on the position size of the trade, which would affect the pip value.

For example, if you set a stop loss of 10 pips for your trade, this could mean $100 or $1000 loss, depending on the lot size you are trading. The number of pips that can be considered a good trade will depend on a range of factors, including the trading strategy you are using and your trading experience. It is a unit of measurement, just like height, weight, length, or temperature. Thus, traders can easily comprehend profits and losses from PIP values.

A pip is the smallest unit of measurement in forex market movements. It measures the changes in the exchange rate of a given currency pair. A pip is the change in the fourth decimal of the exchange rate, except with JPY pairs where it is the second decimal. You should aim to take only those trades where you have a chance to earn three times the pips you are risking on your trade.

NZDUSD is one of the biggest movers on the day – ForexLive

NZDUSD is one of the biggest movers on the day.

Posted: Fri, 03 Feb 2023 08:00:00 GMT [source]

You will hardly ever need to do this calculation as there are multiple online calculators that will do the job for you. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFD and Forex Trading are leveraged products and your capital is at risk. Please ensure you fully understand the risks involved by reading our full risk warning. Although most forex brokers quote currency pairs in the standard four or two decimal places, there are some who use five and three decimal places. They usually quote fractional pips, also known as pipettes. As well as measuring price movements and profits and losses, pips are also useful for managing risk in forex trading and for calculating the appropriate amount of leverage to use.